Why Didn’t the Federal Reserve System Prevent the Great Depression After 1929?

February 20, 2019

© 2019, by Daniel T. Jordan, ASA, CBA, CPA, MBA, based on talks by Milton Friedman1

The Wall Street Crash (1929-1930) was followed by the worst depression in American history. That depression has been blamed on a failure of capitalism. This is not the case but the myth lives on.

What really happened was very different: Although things looked healthy on the surface, businesses had begun to turn down in mid 1929. The crash intensified the recession. So did continuing banks failures in the South and Midwest. But the recession only became a crisis when these failures spread to New York.

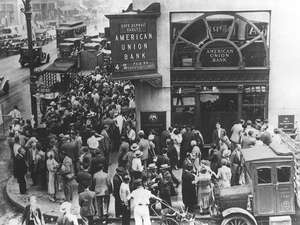

The Bank of the United States (a private bank in NYC) was a good bank but experienced difficulties. The bank was finally liquidated in December 1930, in the worst years of the Depression. This was tragic. It could have been saved by the Federal Reserve Bank of NY with the cooperation of other banks. The Federal Reserve has been set up 17 years earlier precisely to prevent the worst consequences of bank failures. There were banks in far worse financial shape that had come under difficulties before this one and were saved. Why wasn’t this bank saved? It had to do with its rather special character. First, its name, Bank of the United States, which made immigrants believe it was an official governmental bank, although in fact it was an ordinary commercial bank. Second, its character of ownership attracted a large number of depositors from the many Jewish businessmen in the City of New York. Both of them also had the effect of alienating other bankers who did not like the special advantage of the name and the character of the ownership. As a result, other banks were all too ready to spread rumors to help promote an atmosphere in which runs got started on the bank, in which it came into difficulties. And they were less than usually willing to cooperate in the efforts that were made to save the bank.

The Federal Reserve Bank of NY devised a plan in cooperation with the Superintendent of Banking of the State of NY to save the Bank of the US. Their plan called for merging the Bank of the US with several other banks and also providing a guarantee fund to assure the depositors that the assets of the Bank of the US were save and sound. But the Reserve Bank was not able to put the plan into effect because other bankers (including in particular JP Morgan) refused to subscribe to the guarantee fund. The plan was off and the Bank of the US was forced to close its doors.

For its depositors that saw their savings dried up and their businesses to be destroyed, the closing was tragic. The other banks thought the closing of the Bank of the United States would have purely local effects. They were wrong: partly because it had so many depositors, partly because so many of the depositors were small businessmen, and partly because it was the largest bank that had ever been permitted to fail in the US up to this time. The effects were far-reaching. Depositors all over the country were frightened about the safety of their funds and rushed to withdraw them. There were runs. There were failures of banks by the droves. And all the time, the Federal Reserve stood idly by when it had the power, the duty, and the responsibility to provide the cash that would have enabled the banks to meet the insistent demands of the depositors without closing their doors.

After the stock market crashed from 1929 to 1930, the Federal Reserve System allowed the quantity of money to decline slowly, thereby throttling the monetary structure. By December 1930, the quantity of money had fallen by 3%, which may not seem much. But a growing economy needs additional money in order to prevent deflation and other problems. The quantity of money in the US fell by a third between 1929 and 1933. The Federal Reserve could have prevented the runs from having the disastrous consequences they did by stepping in and providing the banking system the cash it needed to meet the demands of the depositors.

If the Federal Reserve had stepped in and bought government securities on a large scale and provided cash, the depositors would have found they could have gotten their money and they would have stopped asking for it.

According to Milton Friedman, the Depression was caused by the government. It was the result of bad government. It was the result of government actions not working the way they were intended to. The Federal Reserve System was established in 1914 for the purpose of preventing things like the Great Depression. And yet in Mr. Friedman’s opinion, its existence was responsible for the depth of the depression.

Additionally, due to the failures committed by the Fed, more permanent changes were introduced in the institutions of the country.

If a private organization makes a mistake and does things badly, it will lose money and eventually will have to go out of business.

What is the logic that if a public organization does things badly, and governmental organizations evidently make bad mistakes, their programs will be expanded?

It will be expanded because they say we did not have enough resources or else it will be left to stand and another organization will be set up to do what it was supposed to do. That is the case here. The Federal Reserve System was established to prevent the bank runs and bank failures that happened during the Great Depression. However, they made it worse. They were supposed to provide liquidity and instead they reduced liquidity. As mentioned above, the quantity of money in the US fell by a third between 1929 and 1933. The Federal Reserve had at all times during that period the power to prevent that decline. But it didn’t do it. And so what happened? The Fed was not abolished but the Federal Deposit Insurance Corporation (FDIC) was created in 1933 to do what the Fed was supposed to do, namely preventing bank runs.

While the private system abounds in the survival of the fittest, the governmental system abounds in its expansion of mistakes. And there is no mechanism for eliminating governmental agencies which either are no longer needed or have behaved perversely.

- Milton Friedman was an American economist who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the complexity of stabilization policy. ↩